The Bitcoin market has been down for two months, with selling pressure from investors keeping prices supressed. While this represents a bearish trend for the leading crypto network, there may be a silver lining after all.

A tweet from the market intelligence platform CryptoQuant revealed that the Bitcoin market is deleveraging. Historically, such events have presented good and profitable opportunities for traders in the short and medium terms. So, such patterns may be replicated in the current market.

Bitcoin Market is Deleveraging

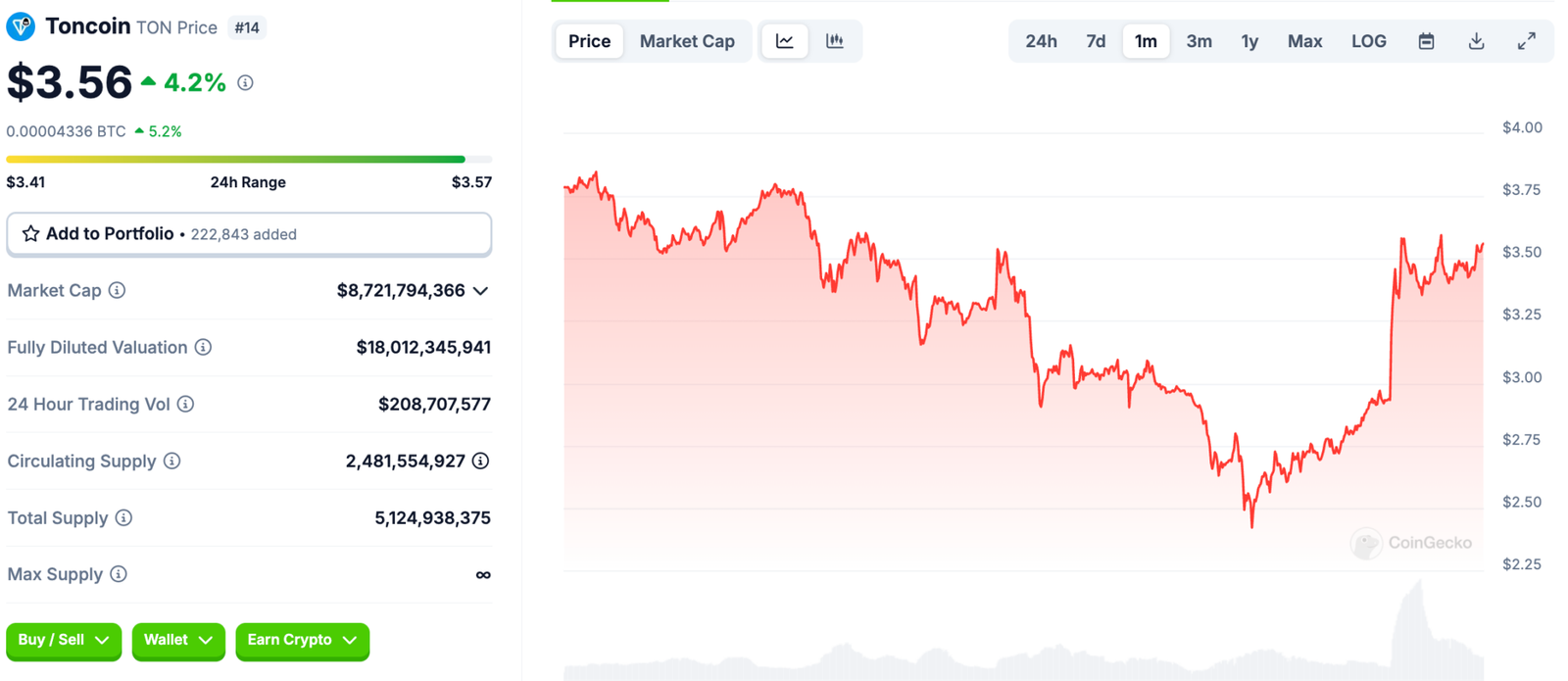

According to pseudonymous CryptoQuant analyst Darkfost, Bitcoin open interest reached an all-time high of $33.6 billion on January 17, a sign that the leverage in the market had never been so high.

At the time, BTC was trading above $100,000. This was three days before United States President Donald Trump’s inauguration, which saw BTC rally to $109,114 for the first time ever. In the last two months, BTC has erased almost all the gains it recorded before the inauguration due to uncertainty stemming from Trump’s new trade policies.

President Trump’s tariffs against America’s trade partners triggered a panic selling of digital assets and a massive liquidation of leveraged positions on Bitcoin. More than $10 billion in open interest has been wiped out from the Bitcoin market since late January, with the bulk of the liquidations seen between February 20 and March 4.

Open interest in the Bitcoin market was around $23 billion at press time. Darkfost said such market moves are considered natural resets because they play a critical role in sustaining a bullish continuation in every cycle.

BTC Holders Show Resilience

An Aggregated Open Interest of Bitcoin Futures Top Exchanges chart analyzed by CryptoQuant often reflects this deleveraging trend by showing that the 90-day open interest change has turned negative. The chart currently shows that the 90-day change in Bitcoin futures open interest has plummeted sharply, falling to -14%.

“Looking at historical trends, each past deleveraging like this has provided good opportunities for the short to medium term,” Darkfost asserted.

Meanwhile, Bitcoin holders are showing resilience despite the decline in prices. CryptoQuant’s analysis shows a rapid increase in the percentage of BTC held between three to six months. This trend reflects a holding behavior among investors and mirrors an accumulation pattern seen during the prolonged correction in mid-2024.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Leave a Comment