Bitcoin is down nearly 25% from all-time highs of around $109,000, registered in January 2025. With prices now below not only $100,000—a key psychological price line—and $90,000—a multi-week reaction line and former support—but also inching closer to $80,000, traders are cautious yet optimistic. Historically, drops pushing the coin to the 20% to 30% levels are often followed by sharp price recoveries.

The problem is that, even though history can serve as a reference point, no one knows how prices will act in the next few trading sessions. For this reason, there is a lot of speculation, with many saying Bitcoin—and by extension, some of the best altcoins to buy in 2025—could be stabilizing, bottoming out as buyers prepare for the next phase of growth.

Are There Signs?

As mentioned earlier, it is not unusual for Bitcoin to drop by between 20% and 40% after sharp price gains. If anything, losses can be more severe, as seen during the bull runs of 2017 and 2021, and what followed in 2018 and 2022.

The same script might play out in 2025 after the rally of 2024, which saw Bitcoin and top altcoins—some considered the next breakout tokens that could explode in 2025—registering new all-time highs.

For this reason, there is caution and anxiety, especially now that prices are stagnant and the total market cap is struggling below $3 trillion. Bitcoin is continuously trending toward the lower band of the $80,000s, increasing the probability of a possible close below the $75,000 support in a bear trend continuation formation.

The good news is that sentiment is improving, and it may not be all doom and gloom. Open interest in Bitcoin futures is waning, indicating that speculators have been flushed out, leaving behind HODLers and organic demand.

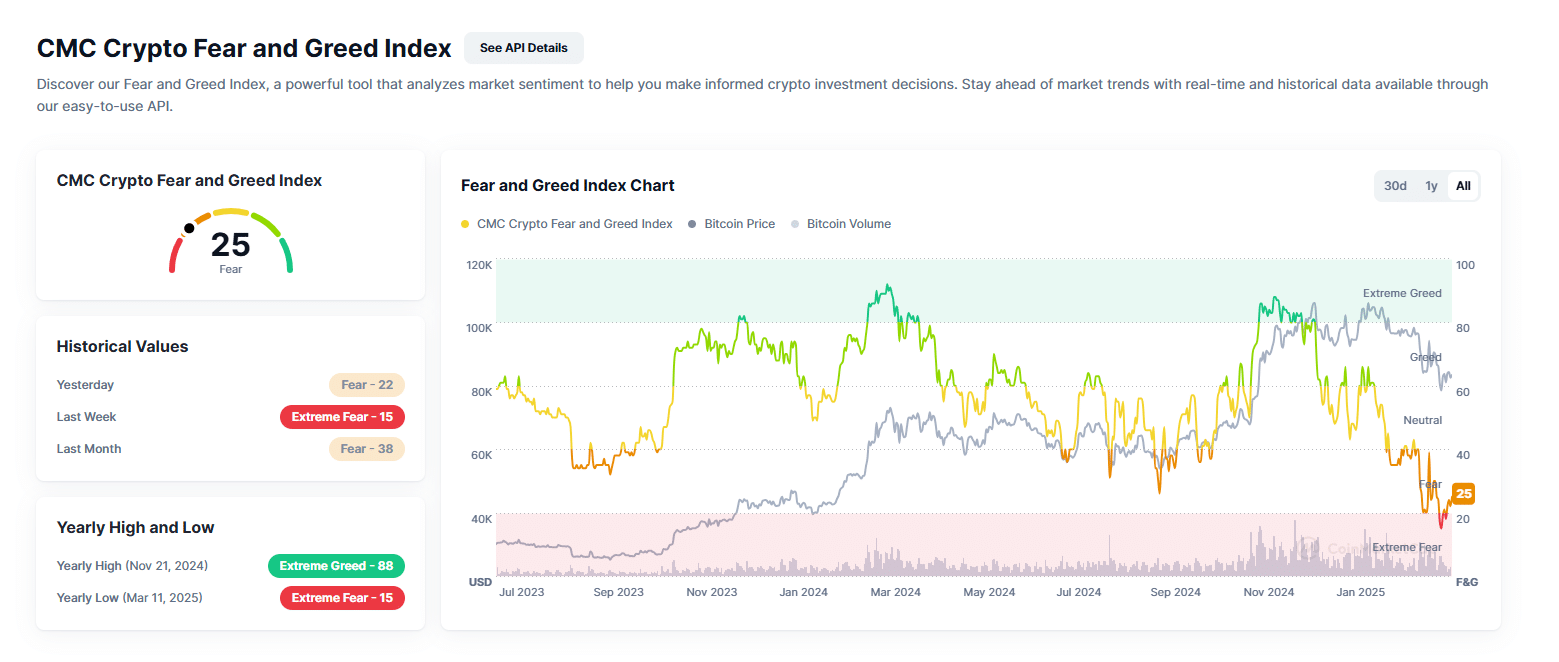

This is happening as sentiment improves. According to the Crypto Fear and Greed Index, the reading has risen from “extreme fear” to “fear,” a move that strengthens the possibility of a price bottom.

Explore: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Michael Saylor Bullish, MicroStrategy Buys More Bitcoin

Amid this, institutions remain committed.

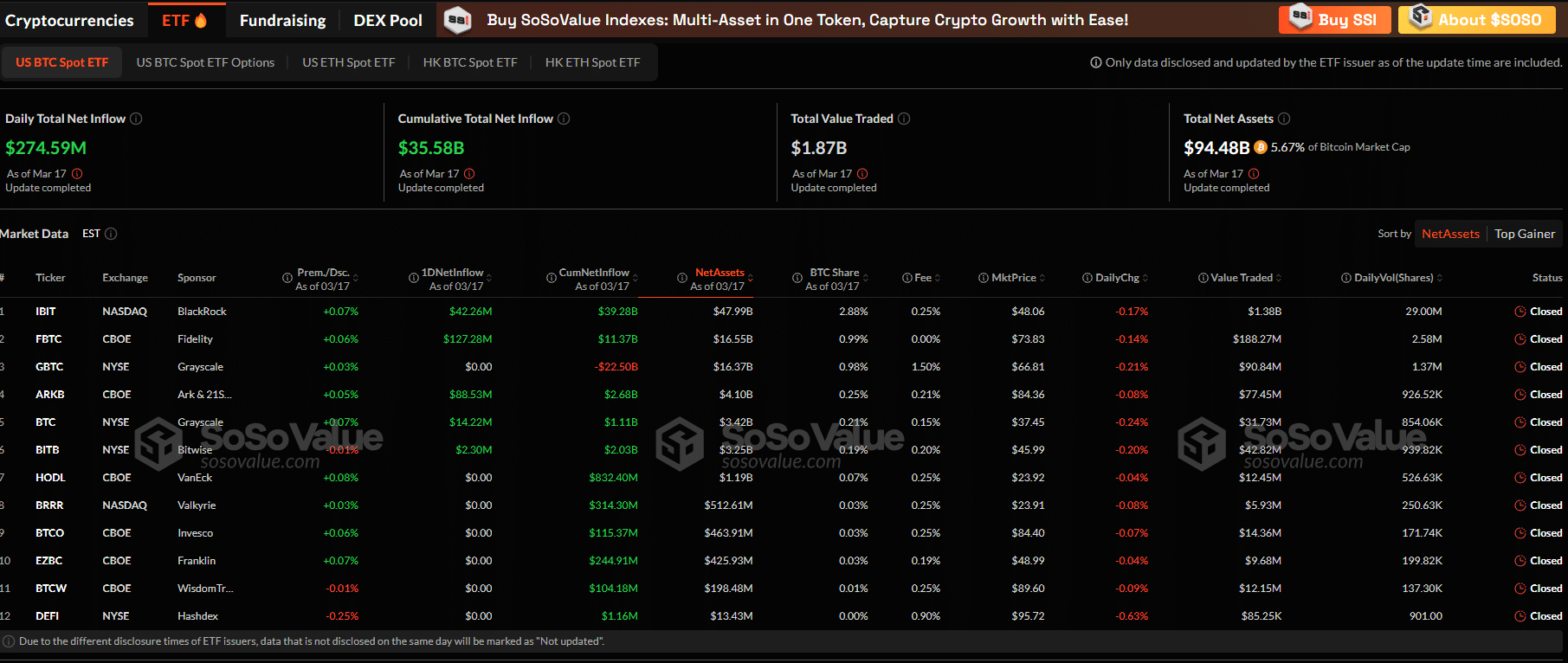

According to Soso Value, over $274 million of BTC-backed shares were bought by institutions by the close of March 17. This was the largest inflow since February 4.

Additionally, MicroStrategy is not giving up and is aggressively accumulating Bitcoin. They recently bought $10.7 million worth of BTC at an average price of $82,981.

Strategy has acquired 130 BTC for ~$10.7M at ~$82,981 per bitcoin and has achieved BTC Yield of 6.9% YTD 2025. As of 3/16/2025, we hodl 499,226 $BTC acquired for ~$33.1 billion at ~$66,360 per bitcoin. $MSTR $STRK https://t.co/8xRmR8vlIt

— Michael Saylor

(@saylor) March 17, 2025

They now hold nearly 500,000 BTC, worth over $33 billion.

In a recent interview, the founder, Michael Saylor, said that despite current economic uncertainty—especially due to President Donald Trump’s tariffs—he remains bullish on Bitcoin.

The Strategic Bitcoin Reserve represents a strategy for U.S. digital supremacy in the 21st century. In this presentation, I discuss why Bitcoin is critical to our nation’s prosperity and how America can become the global Bitcoin superpower. pic.twitter.com/5e6PpxSgzM

— Michael Saylor

(@saylor) March 12, 2025

He believes changes in United States monetary policy could drive demand for risk-on assets like BTC and even some of the best presale projects in 2025. Bitcoin, in his view, is also a perfect store of value and a hedge against inflation.

This preview comes as the trading community looks forward to the FOMC meeting on March 19.

On Polymarket, the market expects a 100% probability that QT will end before May.

If the Fed ends QT, it could signal a shift toward a more accommodative monetary policy, which would support the stock market and Bitcoin, lower government bond yields, and weaken the dollar. pic.twitter.com/3PNPKWyTyF

— Axel

Adler Jr (@AxelAdlerJr) March 18, 2025

On Polymarket, punters believe the Federal Reserve will end quantitative tightening before May. Once this happens, crypto prices will likely rip higher.

Explore: Best Meme Coin ICOs to Invest in March 2025

Is Bitcoin Bottoming? Strategy Stacks As Institutions Bet Big

- Bitcoin is down 25% from $109,000 and inching closer to the $75,000 to $80,000 support

- Strategy adds 130 BTC for $10.7 million, pushing holdings to nearly 500,000 BTC

- Institutions demand rising, over $274 million of spot Bitcoin ETF shares bought on March 17

The post Is This The Bottom? Michael Saylor Says Yes – But When Will Bitcoin and Crypto Recover? appeared first on 99Bitcoins.

Leave a Comment