Ethereum (ETH) registered some minor gains in the past week, rising by 2.80%. Nevertheless, the prominent altcoin remains far from breaking out of a downtrend stretching as far back as December. Amid this bearish market state, renowned market analyst Ali Martinez has highlighted critical price levels in deciding if ETH’s correction is over and suitable for a market entry.

Ethereum: A Buying Opportunity Or More Downside Ahead?

In a detailed analysis post on X, Martinez explains that Ethereum has crashed by 57% from its local peak of $4,100 in December. This decline has been attributed to a widespread distribution by large Ethereum holders, especially the whales. Over the past four months, wallets holding 10,000 ETH have declined by 80. Meanwhile, ETH whales i.e. wallets holding 100,000 ETH and above, have offloaded 130,000 ETH within this period.

During ETH’s decline, the Ethereum Spot ETFs have also suffered massive withdrawals as indicated by a net outflow of $760 million in just the last month. Furthermore, investors have transferred 100,000 ETH to investors with intentions to sell in fear of a price loss.

Looking forward, Martinez notes several technical indicators further suggest a downside for Ethereum amid this intense selling pressure. For example, a breakdown from an ascending triangle on the 3-day charts suggests ETH may be headed for a price target of around $1,000.

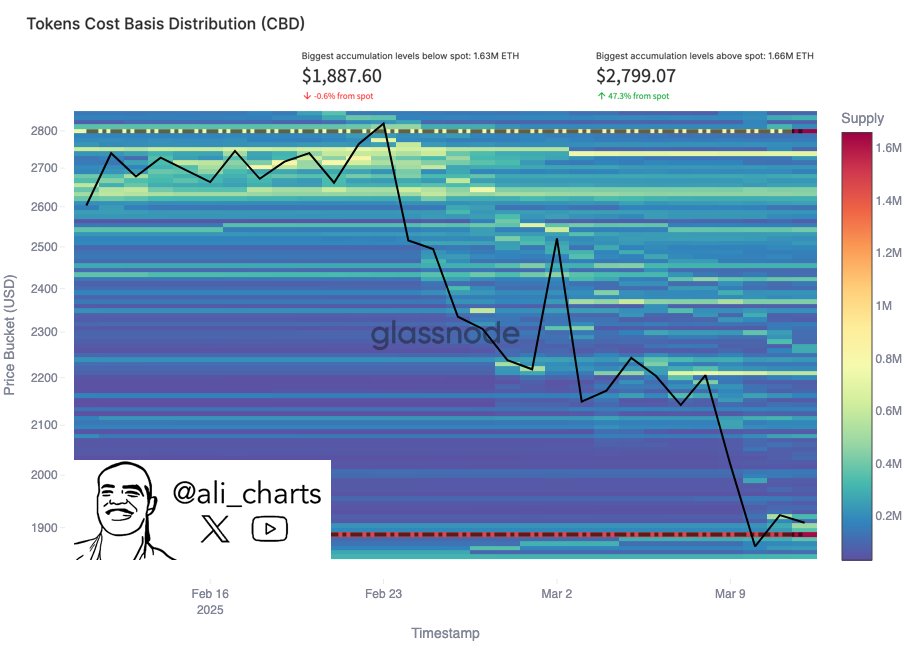

Meanwhile, the ETH pricing bands have also highlighted $1,440 as another downside target indicating a potential 27.4% decline from current market prices. Interestingly, data from the Cost Basis Distribution correlates with both bearish projections as Ethereum is currently above key support at $1,887. However, a price fall below this level will result in a further decline to lower targets such as $1,440, $1250, and $1,000.

Albeit, Martinez notes there is potential for an ETH market recovery. By analyzing the amount of ETH acquired at each price level, the analyst notes that ETH bulls are facing a serious resistance between $2,250-$2,610. If ETH bulls can push past this resistance, it would invalidate the current bearish market outlook.

Ethereum Price Overview

At the time of writing, Ethereum was trading at $1,985 reflecting gains of 1.10% in the past day and 2.10% in the past seven days. However, the altcoin is down by 27.32% in the last month. Being the largest altcoin in the market, Ethereum boasts a market cap of $239 billion representing 8.7% of the total crypto market.

Featured image from Ledger Insights, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Leave a Comment