Michael Saylor’s “₿ig things are coming” post on X has set off curiosity and speculation, especially given the bullish undercurrents in the market despite a price dip after the Bitcoin reserve news. Saylor, as MicroStrategy executive chairman, Bitcoin advocate, and White House Crypto Summit attendee, possesses insider insights on something that we likely don’t know.

Saylor post might signal MicroStrategy’s plans to expand its holdings or a tease on insider knowledge of US policy shifts on

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

Price

Volume in 24h

<!–

?

–>

Price 7d

or crypto in general.

Deciphering Saylor: Crypto to Pump soon?

Since 2020, Saylor has transformed MicroStrategy into a Bitcoin-centric corporation, investing billions to hold it as a treasury asset instead of cash. He views Bitcoin as a scarce, inflation-resistant store of value. Saylor often compares it to gold, but superior due to its decentralization.

Trading on a dip at around $82,000, Bitcoin’s short-term price hasn’t dampened its long-term charm.

Michael Saylor has publicly forecasted Bitcoin to reach $1 million or higher per coin in the long term because of its fixed 21 million supply. He also pushed for Bitcoin adoption by calling it “the apex property of the human race.”

In addition, the White House Crypto Summit, hosted by President Donald Trump last week, also provides critical context for Saylor’s statement. Now a crypto supporter, Trump has pledged to position the US as a global leader in crypto. His executive order establishing a Strategic Bitcoin Reserve has strengthened Bitcoin’s legitimacy, which drives bullish sentiment.

The Trump executive order also includes a Digital Asset Stockpile for other seized cryptocurrencies. Saylor, invited to the summit as a key industry figure, might have gained insights into these policies, he could even be on the advisory council, where he could play a role.

Saylor’s position and federal initiatives could mean the “big things” include regulatory clarity, tax incentives, or government-backed Bitcoin adoption. These will all boost demand and supporting Bitcoin’s upward trajectory.

Saylor’s enigmatic post undoubtedly invites speculation about the next phase of Bitcoin’s growth, even amidst short-term corrections.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Stars are Lining up for Crypto: US Government and Institution Join Forces

Apart from Saylor’s tweet, Elon Musk and Vivek Ramaswamy’s involvement with D.O.G.E. (Department of Government Efficiency) adds another layer of optimism for the crypto market. While D.O.G.E. focuses on government efficiency, Musk’s past endorsements of Dogecoin could influence and benefit crypto in general.

Elon Musk-Trump collaboration, alongside Saylor’s Bitcoin advocacy, paints a picture of a crypto-friendly administration. It could lead to streamlined regulations, faster ETF approvals, and government crypto initiatives. The synergy could imply that “big things” hint at a crypto market uplift, where Bitcoin and the general crypto market will benefit from heightened institutional and governmental backing.

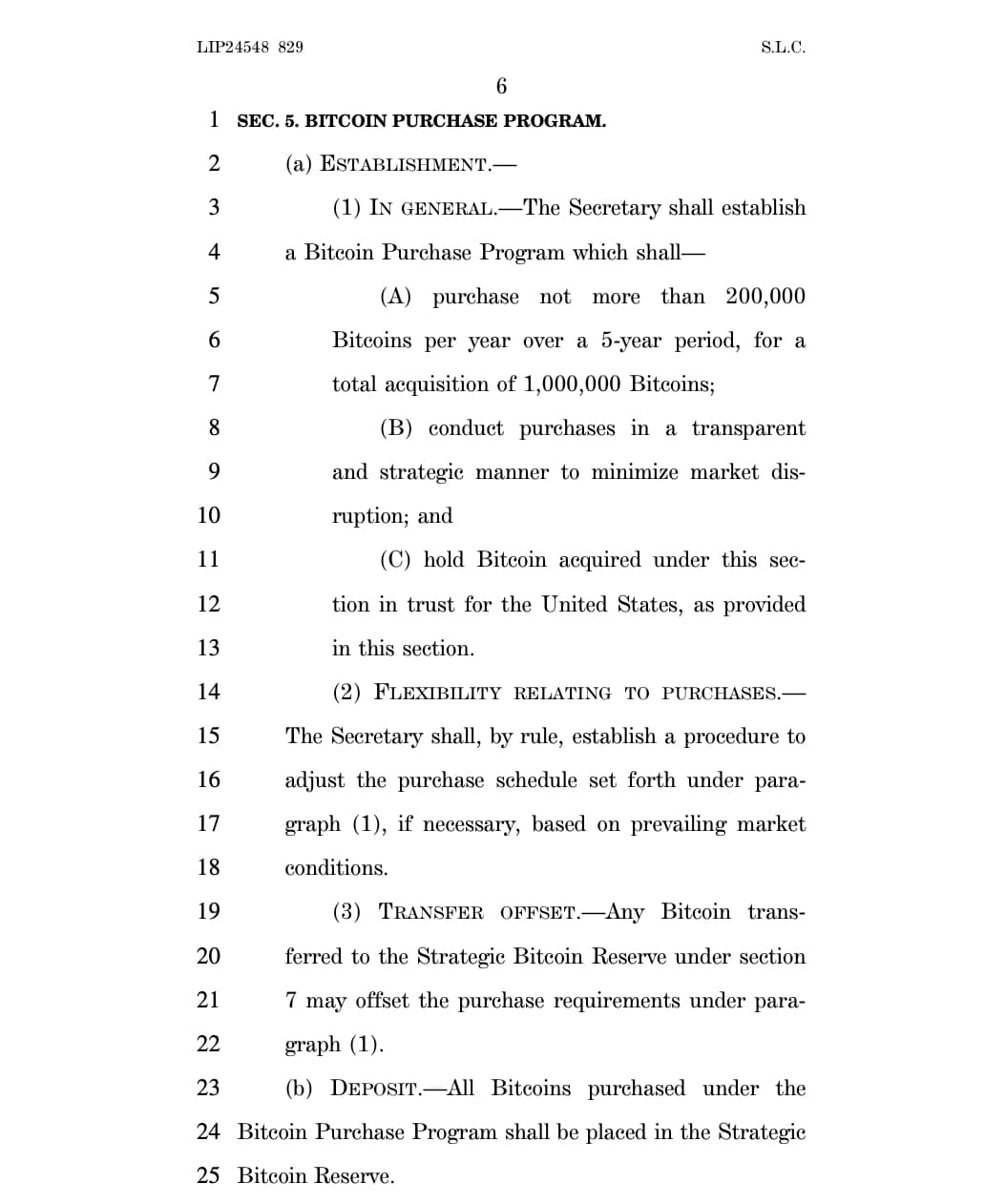

Furthermore, Saylor’s timing aligns with US Senator Cynthia Lummis’s BITCOIN Act. The act proposes a strategic Bitcoin reserve that holds about 5% of the total supply, akin to gold reserves.

(Source)

Combined legislative efforts, Saylor, with his MicroStrategy and Trump’s executive actions, can push Bitcoin into the US financial strategy.

Technically, Bitcoin’s current dip mirrors a typical market cycle. Bitcoin and crypto fundamentals remain strong. The 2024 halving reduced miner rewards, reducing supply, which drives on-chain metrics. Bitcoin and the general crypto market have experienced a hash rate growth and increase in new wallet addresses, indicating a healthy network.

While Saylor’s post could show that he anticipates a policy-driven rally, MicroStrategy is strengthening its position by stacking Bitcoins in the dip.

MicroStrategy’s ambition to scale its Bitcoin holdings to $150 billion drives demand while stabilizing prices over time. Saylor’s “big things” likely hint at a mix of corporate strategy, government policy, and market dynamics, pointing toward Bitcoin’s continued ascent.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Dechipering Saylor’s “₿ig things are coming” post.

- Crypto to get a huge inflow of mass adoption soon with the government and institutions pushing.

The post What Does Saylor Know That We Don’t? Big Things Are Coming From White House Crypto Summit? appeared first on 99Bitcoins.

Leave a Comment